Special Meeting of the Port Phillip City Council

26 June 2024

|

Welcome Welcome to this Special Meeting of the Port Phillip City Council. Council Meetings are an important way to ensure that your democratically elected representatives are working for you in a fair and transparent way. They also allow the public to be involved in the decision-making process of Council. About this meeting There are a few things to know about tonight’s meeting. Only the items specified in the agenda will be considered unless all Councillors are present and unanimously agree to include another matter on tonight’s agenda. Each item has a report written by a Council officer outlining the purpose of the report, all relevant information and a recommendation. Council will consider the report and either accept the recommendation or make amendments to it. All decisions of Council are adopted if they receive a majority vote from the Councillors present at the meeting.

|

Public Question Time and Submissions This meeting is a Special Meeting to consider the Council Plan and Budget 2024-25. There is no provision for public participation, to ask questions or submissions during this meeting. Members of the public are more than welcome to attend the meeting, however in accordance with Council's Governance Rules, there is no provision to ask questions or make submissions. Community Engagement on the Council Plan and Budget 2024-25 was held from 18 April - 13 May 2024. Council also heard feedback on the Council Plan and Budget from the community at the Special Council Meeting held on 14 May 2023. This Special Meeting will be livestreamed to the community to watch the meeting online. Members of the public can access the livestream via Council's webcast site and Facebook page.

|

|

|

|

|

Special Meeting of the Port Phillip City Council |

To Councillors

Notice is hereby given that a Special Meeting of the Port Phillip City Council will be held in St Kilda Town Hall and Virtually via Teams on Wednesday, 26 June 2024 at 6:30pm. At their discretion, Councillors may suspend the meeting for short breaks as required.

AGENDA

1 APOLOGIES

2 Conflicts of interest

3 Well Governed Port PhilliP

3.1 Council Plan 2021-2031 Year Four - Municipal Health & Wellbeing Plan, Financial Plan, Revenue & Rating Plan, and Budget 2024-25: Adoption........................... 6

Special Meeting of the Port Phillip City Council

26 June 2024

1. Apologies

2. CONFLICTS OF interest

3.1 Council Plan 2021-2031 Year Four - Municipal Health & Wellbeing Plan, Financial Plan, Revenue & Rating Plan, and Budget 2024-25: Adoption.............................................................. 6

Special Meeting of the Port Phillip City Council

26 June 2024

|

Council Plan 2021-2031 Year Four - Municipal Health & Wellbeing Plan, Financial Plan, Revenue & Rating Plan, and Budget 2024-25: Adoption |

|

|

Executive Member: |

Lachlan Johnson, General Manager, Operations and Infrastructure JOANNE MCNEILL, EXECUTIVE MANAGER, GOVERNANCE AND ORGANISATIONAL PERFORMANCE |

|

PREPARED BY: |

Peter Liu, Chief Financial Officer Spyros Karamesinis, Head of Financial Business Partnering, Analysis & Compliance Jacky Bailey, Head of Corporate Planning Monique Cosgrove, Head of Stakeholder Engagement |

1. PURPOSE

1.1 To present for adoption, with consideration of the results of the community consultation, the updated Rating Strategy 2022-25 and the Council Plan 2021-2031 updated for year four including the Budget 2024/25 and the declaration of rates and charges for 2024/25.

2. EXECUTIVE Summary

2.1 Council adopted the Council Plan 2021-31, incorporating Community Vision, Municipal Health & Wellbeing Plan, Revenue & Rating Plan and Budget on 23 June 2021. The Plan sets out a 10-year vision and five strategic directions for the city, with a four-year focus on the specific actions Council will undertake to work towards achieving this vision.

2.2 The Local Government Act 2020 (the Act), requires Council each year to:

2.2.1 review the Council Plan to determine whether the strategies, actions and measures require adjustment; and

2.2.2 develop an annual Budget and Financial Plan, which includes detail on the capital and operating programs.

2.3 The 2024/25 budget process commenced with the adoption of the 10-Year Financial Outlook in December 2023 to establish the core principles and budget parameters to be used throughout the budget development process.

2.4 This year, Council also conducted a detailed review of the Rating Strategy 2022-2025. While the current Rating Strategy is not due for renewal until 2025, it is good practice to ensure the policy remains relevant reflecting current operating environment and continues to deliver on the objectives of the Strategy.

2.5 Overall, the current the Rating Strategy is working as intended. However, issues were identified with certain land uses within the municipality that do not align with the broader objectives of the Council Plan and cause negative impacts on amenity, safety and vibrancy to the community. This is evidenced by numerous community and councillor requests recorded in our customer request system and actioned accordingly. Through this review process, three new categories of land have been identified:

2.5.1 Derelict land and buildings that are left in a state of disrepair, unsightly, raise health and safety concerns, promote anti-social behaviour or which cause loss of neighbourhood amenity.

2.5.2 Unactivated retail land including shops that are not open for trade for more than 24 months which hinders retail vibrancy & business activation and negatively impacts municipal streetscapes.

2.5.3 Vacant land which is not developed in a timely manner that otherwise would result in a more vibrant and liveable city.

2.6 The Council Plan 2021-2031 updated for year four, draft Budget 2024/25 and updated Rating Strategy 2022-25 were consulted on with the community from 18 April to 13 May 2024.

2.6.1 The community were consulted specifically on the proposed increase to general rates as well as proposed new differential rating categories (derelict land, unactivated retail land, and vacant land). Community members were also encouraged to provide other feedback on the draft Council Plan and Budget.

2.6.2 A rigorous engagement and communications program was implemented to obtain community feedback. It included an online survey, eight pop-up conversations in various neighbourhoods across the municipality, targeted letters to those most affected, emails received from community stakeholders and hearing of feedback at a Special Council Meeting.

2.6.3 A total of 382 people participated in the engagement program. All feedback received has informed the final Council Plan Year 4 and Budget 2024/25. A summary of the engagement can be found in Attachment 8 and submissions received in Attachment 9.

2.6.4 Responding to the engagement feedback, some minor changes were made to the proposed Rating Strategy 2022-25 including:

· The inclusion of an internal review process in additional to the statutory process for managing objections on the classification of land.

· Refinement of the definition of vacant land to exclude properties in the financial year after an approval has been issued at the frame stage in accordance the Building Permit. Therefore, properties where construction has progress beyond this point will revert to their substantive classification in the following financial year.

2.6.5 Following consultation on the updated Rating Strategy 2022-25, the number of properties classified as vacant, derelict and unactivated land has reduced by eleven properties. This reduction is due to shops being activated and opened for trade and significant construction underway for some vacant land. There were also several long-term vacant land properties that have commenced the planning process, suggesting that the updated rating strategy is encouraging development and therefore working towards achieving its objective.

2.7 Since the release of the draft Council Plan and Budget 2024/25, the proposed cumulative cash surplus has reduced from $0.66 million to $0.62 million due to the following changes (outlined in detail in Attachment 5):

2.7.1 new or updated information such as changes to our operating environment including the ongoing impact of inflation and interest rates and State Government Budget setting statutory fees below inflation.

2.7.2 additional expenditure to manage tree maintenance while managing additional requirements to comply with electrical line clearance requirements.

2.7.3 updates to timing of delivery and costs associated with deliver of the project portfolio including securing additional external project funding.

2.7.4 the outcomes of the community consultation including:

· Elwood Park Tennis Club – To provide total funding of $85,000 towards proposed capital works including $60,000 to install a tree root barrier and $25,000 towards asset renewal works.

· South Melbourne Symphony Orchestra – To provide to the South Melbourne Symphony Orchestra $9,000 per annum commencing 2024/25, for three-years, to cover the budget shortfall caused by the need to rent a space outside the municipality while the South Melbourne Town Hall undergoes works.

2.8 Budget 2024/25 demonstrates a prudent approach to financial management, includes provisions for targeted relief to our community facing cost of living pressures and responds to the various financial risks facing Council while still providing significant investment in services and infrastructure over the 10-year period to deliver on the Council Plan vision and outcomes related to an inclusive, liveable, sustainable, vibrant, and well governed Port Phillip.

2.9 That said, the ongoing rate capping deficit remains a key long-term financial challenge as highlighted in the updated 10-year Financial Plan. Inflation continues to trend higher than the annual rates cap set by the Minister of Local Government. Councils have been required to fund the shortfall between the annual rates cap and actual inflation. See table:

|

Annual |

Actual Rates Increase |

Inflation (Melbourne) |

Shortfall (Rates increase vs inflation) |

|

|

2021/22 |

1.50% |

1.50% |

2.90% |

(1.40%) |

|

2022/23 |

1.75% |

1.75% |

6.10% |

(4.35%) |

|

2023/24 |

3.50% |

2.80% |

5.60% |

(2.80%) |

|

2024/25 |

2.75% |

2.75% (proposed) |

>3.40% |

(0.65%) |

2.10 Within the rates capping environment and inflation trending above the rates cap, Council must also accommodate significant cost pressures including:

2.10.1 an increase in the Superannuation Guarantee Charge from 11 per cent to 11.5 per cent.

2.10.2 increases above inflation to WorkCover (50 per cent) and insurance premiums (15 per cent).

2.10.3 decline in developer open space contributions due to the increase in build to rent developments in the municipality. This impacts Council’s ability to expand and create new public open space despite a growing population.

2.10.4 general decline in building development activity across the municipality.

2.10.5 increased costs in tree maintenance due to wet summer leading to increased tree growth and need for electrical line clearance works.

2.10.6 rising costs associated with delivering some of Council’s core services such as:

· The increasing cost base of Council’s long day care service coupled with changes in service utilisation with overall declining birthrates and dropping attendance momentum in part associated with a prevalence of work from home.

· Council’s decision to exit from the delivery of funded in home aged care services on 21 February 2024. This decision included a commitment to increase Council funding towards aged care services and connection across the City.

2.11 while also minimising the increase of rates and charges in a high inflation environment including a general increase in fees and charges of 3.65 per cent based 0.25 per cent above forecast inflation (consistent with Council’s financial strategy), unless supported by benchmarking to provide targeted relief or cost recovery.

2.12 Before efficiency savings targets are applied, Budget 2024/25 includes a rates cap deficit of $106 million over the next 10 years which is an increase of $23 million since the adoption of Budget 2023/24 and 10-year Financial Plan. This growth in the rates cap deficit has been caused predominantly by persistently high inflation.

2.13 It is expected that continued delivery of ongoing efficiencies and cost savings will play a key role in addressing the rates cap deficit along with other strategic levers such as setting fair and appropriate user charges, careful management and prioritisation of expenditure, and appropriate use of borrowing and reserves.

2.14 A one per cent efficiency target per annum has been included in the Financial Plan. However, it is becoming increasingly hard for Council to identify new efficiencies in our operations, this is also made harder due to persistently high inflation.

2.15 Budget 2024/25 includes efficiency savings of $1.5 million which results in $6.4 million of total permanent savings delivered in the four budgets of this elected Council. Cumulative savings through achieving annual permanent efficiency savings since the introduction of rates capping in 2016/17 are more than $113 million.

2.16 Despite these significant challenges, Council is also committed to provide ongoing targeted financial support including:

2.16.1 Increasing the Council-funded pensioner rates rebate by $10 or 4.8 per cent to $220 in 2024/25 – noting that the City of Port Phillip is one of the few councils that offer this scheme in addition to the State Government rebate.

2.16.2 Continuation of existing business support with the Economic Recovery Package until June 2025.

2.16.3 Additional $40,000 funding for greater food support within the municipality. This is to respond to the greater demand for food relief.

2.16.4 One of Victoria’s most supportive rates and charges hardship relief schemes to individual and business ratepayers including payment plans, one-off waivers in cases of extreme financial hardship, and a Council funded pensioner support.

2.17 The rating structure for 2024/25 is consistent with the updated Rating Strategy 2022-25 (Attachment 1), which includes:

2.17.1 An average rate increase of 2.75 per cent, which is equivalent to the rates cap set by the Victorian Government and lower than inflation.

2.17.2 New higher differential rates for Derelict Land, Unactivated Retail Land and Vacant Land to address neglected land use that results in negative impacts to the municipality due to being under-utilised, causing safety and amenity concerns, vibrancy concerns, and not contributing to the overall purpose and objectives of the Council Plan

2.17.3 Default Waste Charge to increase by 2.72 per cent at $203.60 which is lower than inflation.

2.17.4 Refinement to the Waste Charge structure to achieve outcomes that are fair, efficient to administer, and simple to understand for our community. This means all separately titled car spaces and storage areas will no longer be charged waste charges from 2024/25.

2.18 Council continues to renew and grow community assets through project investment in 2024/25 of $127 million. Budget 2024/25 includes additional project investment over the 10-year period:

2.18.1 $45.9m for the acquisition of public open space to cater for Council’s growing population including creating new parks and green open space in Fishermans Bend and in areas across the City with lower access to these vital amenities.

2.18.2 $0.8m provision over the next three years for the renewal of public Closed-Circuit Television (CCTV) to replace equipment nearing end of life. Noting that attempts at external funding of this renewal have so far been unsuccessful.

2.18.3 Updated budgets and timing for the delivery of a range of capital projects over the next 10 years (see detail in Attachments 2-4). Major projects include EcoCentre Redevelopment, South Melbourne Town Hall redevelopment, Shrine to Sea – Kerferd Road Forecourt and Median Works, St Kilda Pier Landside Works and Elder Smith Netball Courts and Pavilion.

2.19 This ongoing significant investment in our community assets and continuing to deliver the core services of Council while maintaining:

2.19.1 No debt – excluding finance lease liabilities which will remain as part of our financing strategy.

2.19.2 Cash reserves for operational needs including staff leave and contingency of $16.3 million.

2.20 The updated Council Plan for year four and Budget 2024/25 is also informed by other previously endorsed strategies such as the Enterprise Asset Management Plan 2022-2032, Waste Management Strategy 2022-25, Integrated Transport Strategy, Act and Adapt Strategy, and Public Space Strategy.

|

PART 1 That Council: 3.1 Notes that community consultation on the updated Rating Strategy 2022-25 took place from 18 April to 13 May 2024, with the results of the consultation summarised in Section 5 of this report and detail provided in Attachment 8. 3.2 Notes that, upon completion of the consultation period, the following changes to the Rating Strategy 2022-25 have been proposed to respond to the feedback: 3.2.1 Inclusion of an internal process to manage objections to classification of land (in addition) to the statutory process. 3.2.2 The definition for vacant land to be amended to include an exemption for properties in the financial year after approval at frame stage has been provided in accordance with Building Permit issued for the development of the site (under the Building Act 1993) and provided that the building permit has not expired. 3.3 Notes that since the updated Rating Strategy 2022-25 was consulted on: 3.3.1 the number of properties classified as vacant, derelict and unactivated land has reduced by eleven properties. This reduction is due to retail properties being activated and opened for trade and due to construction progressing for several pieces of vacant land. 3.3.2 there are also several long-term vacant land properties that have commenced the planning process, suggesting that the updated rating strategy is encouraging development and therefore working towards achieving its objective. 3.4 Adopts the updated Rating Strategy 2022-25 (Attachment 1) including the expansion of differential rating in 2024/25 to following land types are negatively impacting the municipality due to being under-utilised, causing safety and amenity concerns and not contributing to the overall purpose and objectives of the Council Plan: 3.4.1 Derelict Land calculated at 400 per cent (four times) of the residential rate per dollar. 3.4.2 Unactivated Retail Land calculated at 400 per cent (four times) of the residential rate per dollar. 3.4.3 Vacant Land calculated at 300 per cent (three times) of the residential rate per dollar. PART 2 That Council: 3.5 Notes that, as the State Government’s Fire Services Levy is included in Council’s Rates Notices and collected by Council on behalf of the State Revenue Office, it is important to be transparent with our community that they are not Council charges and Council is not responsible for the significant increases in 2024/25. The increases for 2024/25 include: 3.5.1 Fixed component of the Fire Services Levy to increase by 5.1 to 5.6% depending on the type of property. 3.5.2 Variable component of the Fire Services Levy to increase between 4% for industrial properties to 89% for residential properties. 3.5.3 Majority of residential properties will see an increase between $30 to $140 depending on the value of their property. The increase is greater than the increase of Council’s rates & charges between 50% to 200% more. 3.6 Endorses a 2.75 percent average rate increase for 2024/25 which is consistent with the rates cap set by the Victorian Government and is lower than inflation. 3.7 Declares rates Budget 2024/25 as required by Section 94 of the Local Government Act as follows: 3.7.1 An amount of $135,413,759 to be raised by general rates for the period 1 July 2024 to 30 June 2025. 3.7.2 A differential rate in the dollar based on type or class of land on the 2024 Capital Improved Value of all rateable properties within the municipality:

3.7.3 The properties on Attachment 6 to be “Recreational and Cultural Lands” and that the level of general rates for these properties be set in accordance with percentages of the general rate also shown in this attachment. 3.7.4 Grants a rebate equivalent to half the general rate for the elderly persons flats as outlined in Attachment 7, in accordance with the agreement between Council and the Ministry of Housing. 3.7.5 Subject to the consent of the Minister for Local Government, treats any person(s) who has been excused the prescribed amount of the general rate for the year ending 30 June 2024 in accordance with the State Concessions Act 2004 as being similarly eligible for 2024/25. 3.7.6 A Council rebate of $220 maximum (an increase of 4.8 percent) to those persons who satisfy eligibility requirements noting that the total value of the combined State Government rebate of approximately $259.50 (maximum) and Council rebate will not exceed 50 percent of the general rate payable for the financial year. 3.7.7 A one-off waiver of a maximum of $750 on application up to 50 percent of general rates and charges to the Chief Financial Officer in cases of extreme financial hardship. 3.8 Declares services charges for Budget 2024/25 as required by Section 94 of the Local Government Act as follows: 3.8.1 An amount of $15,066,593 of net waste service charges for the period 1 July 2024 to 30 June 2025. 3.8.2 A default waste charge for all rateable properties of $203.60 and a kerbside FOGO collection charge for single unit dwellings of $68.00. 3.8.3 An annual garbage charge of $450.00 per property on all non-rateable properties that receive waste management services from the City of Port Phillip. Notes additional charges may apply for multiple waste bins. 3.8.4 An annual garbage bin surcharge of $255.00 for properties that are provided with a 240-litre bin for the collection of non-recyclable waste. 3.8.5 An 80-litre waste bin annual rebate of $82.00 for properties that take up a small waste bin. 3.8.6 A private waste collection rebate of $69.50 for residential properties that have private collection for waste. 3.8.7 Removal of the Commercial car park space waste charge for commercial carparks and or storage areas. 3.9 Notes the previously declared special rate schemes for 2024/25: 3.9.1 Port Melbourne Business Precinct for marketing, management and business development to the maximum of $320,000. 3.9.2 Carlisle Street Business Precinct for the purpose of marketing, promotion, business development and centre management expenses up to the maximum of $200,000. 3.9.3 Fitzroy Street and Environs Business Precinct for marketing, management and business development to the maximum of $200,000 based on the new agreement commencing 1 July 2024. 3.9.4 Acland Street Village Business Precinct for marketing, management and business development to the maximum of $187,320 based on the new agreement commencing 1 July 2024. 3.10 Adopts the following payment dates and due dates for rates and associated charges:

3.11 Authorises the Chief Financial Officer and the Coordinator Revenue and Valuations to collect all rates and charges and the Fire Services Property Levy. 3.12 Notes that the penalty interest rate set in accordance with the Penalty Interest Rates Act 1983 at the prescribed rate (10 percent) as at 1 July 2024 fixed by the Governor in Council for general rates and charges that remain unpaid after the payment dates prescribed by the Governor in Council. PART 3 That Council: 3.13 Notes the community consultation on the Council Plan 2021-2031 updated for year four including the Budget 2024/25 took place from 18 April to 13 May 2024, and that is summarised in Section 5 of this report and detail provided in Attachment 8. 3.14 Having considered all the submissions received and those heard at the Council Meeting of 14 May 2024, and having completed its budget deliberations, agrees to include the following community requests into the Budget 2024/25 in addition to those already included as part of the draft Budget 2024/25: 3.14.1 Elwood Park Tennis Club – To provide total funding of $85,000 towards proposed capital works including $60,000 to install a tree root barrier and $25,000 towards asset renewal works. 3.14.2 South Melbourne Symphony Orchestra – To provide to the South Melbourne Symphony Orchestra $9,000 per annum commencing 2024/25, for three-years, to cover the budget shortfall caused by the need to rent a space outside the municipality while the South Melbourne Town Hall undergoes works. 3.15 Directs Officers to respond in writing to thank all those that have made formal written submissions and to advise them of the outcome of Council’s decision. PART 4 That Council: 3.16 Notes the full year forecast for 2023/24 has reduced from $0.24 million to $0.14 million since release of the draft Budget. 3.17 Notes the financial changes identified and incorporated into the proposed Budget 2024/25 in Attachment 5 of this report including timing changes for delivery of the portfolio and additional cost pressures including persistent inflation. 3.18 Notes that the Budget 2024/25 proposed by Officers includes a cumulative cash surplus of $0.62 million providing higher than normal contingency reflective of the current economic operating environment. 3.19 Notes that Budget 2024/25 does not contain any new borrowings. PART 5 That Council: 3.20 Adopts Year 4 of the Council Plan 2021-31, which includes the updated (10-year) Financial Plan, the Revenue and Rating Plan, the Budget 2024/25 and the 10-year community vision as set out in Attachments 2-4, and incorporates all changes made by resolution in this meeting. 3.21 Delegates authority to the CEO to reflect any changes made by Council at tonight’s meeting, which are not reflected in Attachments 2-4, to make minor typographical corrections and changes to images before final publication and to make editorial changes to the Plan that reflect any changed obligations to Council required by state government agencies. |

4. KEY POINTS/ISSUES

4.1 The integrated Council Plan 2021-31 sets a 10-year direction for the City, with a four-year focus on specific actions Council will undertake to work towards achieving this longer-term direction. Each year Council reviews the Council Plan to determine whether the strategies, priorities and measures require adjustment.

4.2 Consistent with the Council Plan and Budget parameters that were considered by Council in 2021, the proposed amendments result from strategic work undertaken during the year, better and updated information related to key budget assumptions, progress in project delivery, updated asset management information, refinement of measures and targets, changes to our strategic and operating risks.

4.3 The Council Plan is supported by a financial strategy which provides clear direction on the allocation, management, and use of financial resources. It aims to ensure that Council remains financially sustainable while maintaining assets and services, responding to growth, and delivering on priorities.

Parameters for review of Council Plan and Budget 2024/25

4.4 On 6 December 2023, officers presented a report to Council to provide an update on changes in our strategic and operating environment and to seek approval of the 10-Year Financial Outlook and the parameters for the review of the Council Plan and development of the Budget 2024/25.

4.5 The financial strategy is embedded in a 10-year Financial Plan and forms part of the updated Council Plan. It sets the parameters within which Council agrees to operate to maintain acceptable financial outcomes over the short, medium, and long term.

4.6 Council released the draft Council Plan 2021-2031 updated for year four and Budget 2024/25 for community consultation at an Ordinary Meeting of Council held on 17 April 2024.

4.7 Consultation on the draft updated Council Plan Year Four and Budget 2024/25 occurred from 18 April to 13 May 2024. The Council’s Have Your Say webpage received 15,151 views by 9,913 visitors. During the engagement period, a total of 382 people and organisations provided feedback on the draft Council Plan and Budget. All feedback received has been reviewed and informed the final Council Plan Year 4 and Budget 2024/25 (Attachments 2-4).

Rating Strategy Review

4.9 On the 29 June 2022 Council endorsed Council’s Rating Strategy 2022-25 (‘Rating Strategy’). This strategy changed Council’s approach to rating including the introduction of a separated waste charge to recover the direct cost of waste services and differential rating for a more equitable rates distribution outcome.

4.10 While the current Rating Strategy is not due for renewal until 2025, it is good practice to ensure the policy remains relevant reflecting current operating environment and continues to deliver on the objectives of the Strategy.

4.11 Overall, our current the Rating Strategy is working as intended. However, issues have been identified with certain land uses within the municipality that do not align with the broader objectives of the Council Plan and the negative impacts on amenity and vibrancy to the community. This is evidenced by numerous community and councillor requests recorded in our customer request system and actioned accordingly.

4.12 Through this review process, three new categories of land have been identified with the following differential rates to address their objectives (full definitions can be found in Attachments 2-4):

4.12.1 Derelict Land

· Derelict land and buildings that are left in a state of disrepair, unsightly, raise health and safety concerns, promote anti-social behaviour or which cause loss of neighbourhood amenity.

· The differential rate for derelict land will be set at 4 times (400%) of the residential rate in the dollar, which is the maximum allowable as the impact to local amenity is significant. This acts to disincentive land being left in unfavourable condition and encourage timely improvement and development.

4.12.2 Unactivated Retail Land

· Unactivated retail land includes shops that are not open for trade for more than 24 months which hinders retail vibrancy & business activation and negatively impact municipal streetscapes.

· The differential rate for unactivated land will be set at 4 times (400%) of the residential rate in the dollar, which is the maximum allowable as the impacts to local amenity and retail vibrancy are significant. This acts to disincentivise land being un-used and to encourage full utilisation and activation.

4.12.3 Vacant Land:

· Vacant land which is not developed in a timely manner that otherwise would result in a more vibrant and liveable city.

· To achieve these objectives, a differential rate for vacant land will be set at 3 times (300%) of the residential rate in the dollar.

· Vacant land is set at a lower differential level due to its lesser degree of amenity impact relative to derelict and unactivated retail land, whilst still incentivising timely development through greater financial imposition.

4.13 Consultation on the updated Rating Strategy was conducted between 18 April to 13 May 2024 in conjunction with the Council Plan and Budget. Over 70 per cent of respondents agreed or strongly agreed with the proposed differential rates for derelict, vacant and inactivated retail land. Of those who disagreed, the key reasons were: factors outside land owners’ control, and a belief that the changes will not achieve positive or desired outcomes.

Updates to Budget 2024/25 since draft Budget:

4.14 Since the release of the draft Budget 2024/25, officers have factored in the following changes to a range of budget items to reflect new and updated information:

4.14.1 A minor $0.1 million decrease to the 2023/24 forecast year end results (April 2024) from what was presented with the Draft Budget 2024/25.

4.14.2 Increase of $0.3 million in projected interest income due to increased cash holding because of updated portfolio delivery timelines.

4.14.3 Additional $0.5 million inflation provision

4.14.4 Additional grant income of $0.28 million secured to part fund works being conducted at JL Murphy Community Pitch.

4.14.5 Reduction in Statutory fee income due the legislative fee increase being set at 2.75% for penalty and fee units which was lower than the budget estimate of 3.40 per cent.

4.14.6 Significant deliverability reviews of the project portfolio have also occurred, adjusting the timing of delivery of several projects to ensure that project timelines are accurate.

4.14.7 A comprehensive list of all financial changes identified and incorporated into the proposed Budget 2024/25 can be found in Attachment 5 of this report.

4.15 Adjusting for the financial changes above and consideration of submissions, officers have included the following Community Requests in the Budget 2024/25:

4.15.1 Elwood Park Tennis Club – To provide total funding of $85,000 towards proposed capital works including $60,000 to install a tree root barrier and $25,000 towards asset renewal works.

4.15.2 South Melbourne Symphony Orchestra – To provide to the South Melbourne Symphony Orchestra $9,000 per annum for three years commencing 2024/25 to cover the budget shortfall caused by the need to rent a space outside the municipality while the South Melbourne Town Hall undergoes works.

Updated overall Budget 2024/25 financial position:

4.16 The impact of the further updates to the Draft Budget results in the cumulative cash surplus increasing from $0.68 million to $0.62 million (decrease of $0.06 million)

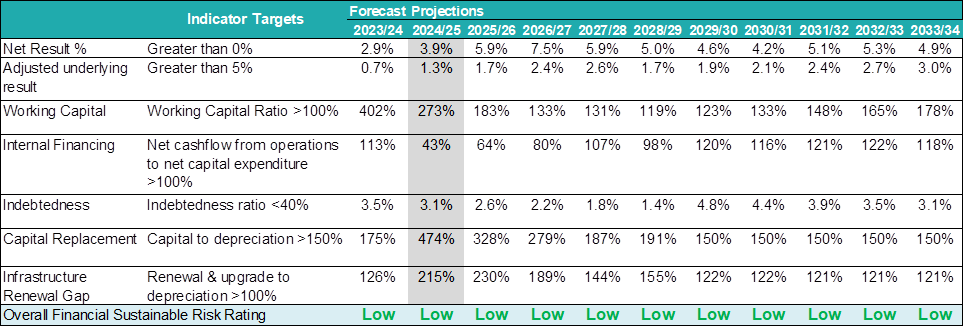

4.17 As outlined in the Financial Strategy in this report, the Plan operates within the rates cap, maintains financial sustainability and an overall low financial sustainable risk rating as measured by the VAGO Financial Sustainability Indicators, whilst investing in essential assets and services.

4.18 The updated financial sustainability table is as follows:

4.19 Budget 2024/25 includes:

4.19.1 Minimising the increase of rates and charges in a high inflation environment with:

4.19.2 An average rate increase of 2.75 per cent, which is equivalent to the rates cap set by the Victorian Government and lower than inflation.

4.19.3 Default Waste Charge to increase by 2.72 per cent at $203.60 which is lower than inflation.

4.19.4 Ongoing targeted financial support including:

· Increasing the Council-funded pensioner rates rebate by $10 or 4.8 per cent to $220 in 2024/25 – noting that the City of Port Phillip is one of the few councils that offer this scheme in addition to the State Government rebate.

· Continuation of existing business support with the Economic Recovery Package until June 2025.

· Additional $40,000 funding for greater food support within the municipality. This is to respond to the greater demand for food relief.

4.19.5 Proposed changes to Rating Strategy 2022-25 as endorsed by Council on 20 March 2024 to proceed with community consultation, including new higher differential rates for Derelict Land, Unactivated Retail Land and Vacant Land to address neglected land use that results in negative impacts to the municipality due to being under-utilised, causing safety and amenity concerns, vibrancy concerns, and not contributing to the overall purpose and objectives of the Council Plan

4.19.6 Refinement to the Waste Charge structure to achieve outcomes that are fair, efficient to administer, and simple to understand for our community. This means all separately titled car spaces and storage areas will no longer be charged waste charges from 2024/25.

4.19.7 Accommodating inflation projected at 3.4 per cent (0.65 per cent greater than the rates cap of 2.75 per cent) and other additional expenditure pressures including the increase to the superannuation guarantee, insurance and Workcover premium increases above inflation.

4.19.8 Efficiency savings of $1.5 million are included in draft Budget 2024/25. This results in $6.4 million of total permanent savings delivered in the four budgets of this elected Council. Cumulative savings through achieving annual permanent efficiency savings since the introduction of rates capping in 2016/17 are more than $113 million.

4.19.9 A general increase in fees and charges of 3.65 per cent based 0.25 per cent above forecast inflation (consistent with Council’s financial strategy), unless supported by benchmarking to provide targeted relief or cost recovery.

4.19.10 No debt – excluding finance lease liabilities which will remain as part of our financing strategy.

4.19.11 Cash reserves for operational needs including staff leave and contingency of $16.3 million.

4.19.12 Project investment in 2024/25 of $127 million to maintain, grow and improve services and assets.

4.19.13 Over the 10-year period, additional project investment for:

· $45.9m for the acquisition of public open space to cater for Council’s growing population including creating new parks and green open space across the municipality including in Fishermans Bend and in areas across the City with lower access to these vital amenities.

· $0.8m provision for the renewal of public Closed-Circuit Television (CCTV) to replace equipment nearing end of life. Noting that attempts at external funding of this renewal have so far been unsuccessful.

· Updated budgets and timing for the delivery of a range of capital projects over the next 10 years (see detail in Attachment 2-4). Major projects include Eco Centre Redevelopment, South Melbourne Town Hall redevelopment, Shrine to Sea – Kerferd Road Forecourt and Median Works, St Kilda Pier Landside Works and Elder Smith Netball Courts and Pavilion.

4.19.14 A cash surplus of $0.62 million providing additional contingency for likely enterprise financial risks.

4.20 Before efficiency savings targets are applied, Budget 2024/25 includes a rates cap deficit of $106 million over the next 10 years which is an increase of $23 million since the adoption of Budget 2023/24 and 10-year Financial Plan. This growth in the rates cap deficit has been caused predominantly by persistently high inflation.

4.21 It is expected that continued delivery of ongoing efficiencies and cost savings will play a key role in addressing the rates cap deficit along with other strategic levers such as setting fair and appropriate user charges, careful management and prioritisation of expenditure, and appropriate use of borrowing and reserves.

4.22 A one per cent efficiency target per annum has been included in the Financial Plan. However, it is becoming increasingly hard for Council to identify new efficiencies in our operations, this is also made harder due to persistently high inflation.

Updates to Council Indicators

4.23 Council indicators provide a snapshot of our annual performance. They are reviewed annually to ensure targets are realistic, descriptors are clear, and that the suite of indicators provides a comprehensive picture of our performance as a Council.

4.24 Since 2022/23 we have included the frequency, each indicator is measured to provide clarity over when we will be reporting on them in the monthly CEO Report, Quarterly Report and Annual Report.

4.25 For 2024/25, the phrasing of all indicators was reviewed, to ensure it accurately describes what is being reported. The resulted in minor amendments to the description of 27 indicators.

4.26 For 2024/25, the following indicators have been added because they are new in the Local Government Reporting Framework (LGPRF):

4.26.1 Recently purchased library collection items

4.26.2 Library loans per population

4.26.3 Library membership per population

4.26.4 Library visits per head of population

4.26.5 Infant enrolments in MCH service

4.26.6 Percentage of food samples obtained per required number of food samples

4.27 For 2024/25, the following indicators have been removed, because they have been retired from the Local Government Reporting Framework (LGPRF) and the outcomes are achieved with other measures, or because data is no longer available:

4.27.1 Proportion of residents who agree Port Phillip has a culture of creativity (data no longer available)

4.27.2 Active library borrowers in the municipality (replaced with the new LGPRF indicator above)

4.27.3 Physical library collection usage (retired from LGPRF because physical collection is no longer a useful way to measure community benefit from the library service)

4.27.4 Percentage of participants accessing sport and recreation programs who are female or gender diverse (data no longer available) – Noting Council is currently developing more appropriate measures as part of the Fair Access Principles.

4.27.5 Proportion of residents satisfied with parks and open space (data no longer available)

4.27.6 Kerbside bin collection requests (retired from LGPRF, and outcome is achieved through existing measures)

4.28 In the Council Plan, significant investment continues to be projected over the 10-year period on important initiatives to deliver on the Council Plan outcomes and priorities:

4.28.1 Integrated Transport Strategy $32 million

4.28.2 Sustainable Environment Strategy $54 million

4.28.3 Public Space Strategy – $130 million

4.28.4 Don’t Waste It! Waste Management Strategy (2023-2025) implementation - $1.9 million.

Gender Impact Assessment

4.1 Officers have incorporated consideration of gender equity in developing the Council Plan and budget, including policies, plans and projects that have a significant impact on the community.

4.2 Council has undertaken gender impact assessments on a range of new and reviewed initiatives, including Council’s Act and Adapt Strategy, Aged Care reforms, Dog off-leash guidelines and Lagoon Reserve upgrade.

4.3 These assessments have identified actions to ensure fairer outcomes for all community members, including improvements to enhance safety, accessibility and inclusion.

4.4 Gender impact assessments currently underway include assessments for Council’s Sport and Recreation Strategy, Children’s Services Infrastructure Redevelopment and a number of public toilet projects.

5. CONSULTATION AND STAKEHOLDERS

5.1 On 20 March 2024, Councillors endorsed the motion to take the updated Rating Strategy 2022-25 document to community engagement.

5.2 The updated draft Council Plan 2021-31 Year 4 including the draft Budget 2024/25 was resolved by Council to be released for community engagement on 17 April 2024.

5.3 Community engagement occurred from 18 April to 13 May 2024. The engagement program included an online Have Your Say page, with background information, a survey and a public forum for questions and answers. Face to face conversations were held at eight neighbourhoods across the municipality where people could speak to officers and councillors about the proposed Council Plan and Budget. Community members could also provide feedback via email or speaking at a Council Meeting on 14 May 2024.

5.4 The communications program to encourage participation included direct letters to potentially affected property-owners of the proposed changes to differential rates, emails to community organisations and other interested individuals, social media campaigns, articles in Council’s electronic newsletters and hard copy facts sheets at the St Kilda Town Hall.

5.5 A total of 382 people and organisations provided feedback on the draft Council Plan and Budget: Online feedback (via survey, Q&A and email) was received from 244 participants. There were approximately 118 participants at the eight pop-up conversations held around the municipality, with an additional 20 speakers at the Council Meeting.

5.6 An Interim Engagement Summary Report on the engagement activities and findings was presented at the Council Meeting on 14 May 2024 and the Final Engagement Summary Report is attached (Attachment 8) including the submissions received (Attachment 9)

5.7 Participants were asked a series of questions focused on changes to the draft Council Plan and Budget, including:

5.7.1 a proposed average rate increase of 2.75 per cent in 2024/25 for Port Phillip property owners.

5.7.2 increasing rates for certain land types that have a negative impact on the amenity of Port Phillip and that are not consistent with Council Plan objectives (derelict land, unactivated retail land, and vacant land).

5.7.3 additional feedback on the proposed Council Plan and Budget.

5.8 Feedback on the proposed changes to local rates was mixed, with almost half of respondents agreeing or strongly agreeing with the proposal, and 35 per cent disagreeing or strongly disagreeing. Of those who disagreed, a small proportion thought the proposed increase should be higher.

5.9 Over 70 per cent of respondents agreed or strongly agreed with the proposed differential rates for derelict, vacant and inactivated retail land. Of those who disagreed, the key reasons were: factors outside land owners’ control, and a belief that the changes will not achieve positive or desired outcomes.

5.10 The key topics raised by the community as general feedback were: sustainability and climate change, more efficient focus on core services, improving streets and laneways, affordable housing, and recreation and parks.

6. LEGAL AND RISK IMPLICATIONS

6.1 The Local Government Act 2020 requires Council to undertake an annual review of the Council Plan and to develop an annual Budget, for adoption by 30 June. The Act also requires Council to engage with our community on these proposed changes and the draft budget in accordance with Council’s Community Engagement Policy.

6.2 The financial and non-financial tables supporting the proposed Budget 2024/25 and Financial Plan have been prepared in accordance with regulations laid down by the Local Government (Planning and Reporting) Regulations 2020.

6.3 Officers continue to monitor and put in place plans to address financial risks that the organisational is facing. The comprehensive risk assessment can be found in Attachments 2-4.

Financial Risks

6.4 Some of the key financial risks faced by Council include (a complete schedule can be found in Attachment 2: Council Plan and Budget Volume 2):

6.4.1 The increasing occurrence of Build to Rent developments (no subdivision) which are not required to pay developer contributions impacting Council’s ability to afford to expand and create new public open space despite a growing population.

6.4.2 The funding and financing plan for Fishermans Bend remains uncertain and is a responsibility of the Victorian Government (as such this is an advocacy priority for Council). There may be a large funding gap between the infrastructure desired at Fishermans Bend and what can be funded. A failure to appropriately budget for the costs of running and looking after new assets in Fishermans Bend is also a potential risk.

6.4.3 Works are progressing to test key sites to quantify the likely financial impact of soil contamination. Projects included in the 10-year plan assume high level estimates of soil contamination.

6.4.4 The 10-year Financial Plan assumes rate capping based on inflation. Since its introduction, the Minister for Local Government has prescribed rates based on forecast inflation, which have been lower that actual inflation. Further, in 2023/24 the rates cap was set lower than inflation which included a 0.5% cost of living factor – the risk of future adjustments has increased with this development. Every 0.1 per cent lower than the ESC methodology equates to a $0.13 million reduction per annum in revenue.

6.4.5 A more subdued property development market may result in rates revenue growing at a lower rate than projected; around 0.5 to 1.3 per cent per annum figure assumed in the 10-year Financial Plan. Every 0.1 per cent reduction in growth equates to a $0.13 million reduction in revenue per annum. This may

Updated Rating Strategy

6.5 The proposed updated Rating Strategy 2022-2025 has been prepared in accordance with the Local Government Act and associated Ministerial Guidelines for Differential Rates.

6.6 Pursuant to Section 161 of the Local Government Act, Council may raise any general rates by application of a differential rate.

6.7 The Act provides a limited range of options for councils to develop rating systems, which have been considered in the Rating Strategy review. The principles within the Rating Strategy are compliant with provisions for developing rates within the Act.

6.8 There are several risks associated with expanding differential rating per the proposed strategy update:

6.8.1 Increase in complaints – Council may experience higher levels of complaints due to the additional complexity of the rating process and also due to the higher rating burden applied to vacant land, derelict land and unactivated retail land.

6.8.2 Affordability – Some ratepayers may not be able to afford to pay the higher differential that applies to their property. This may result in higher numbers of objections. Noting that this may incentivise the ratepayer to improve or develop land, therefore achieving the objectives of the rating strategy.

6.9 An additional consideration for the expansion of differential rating is the impact that this will have on the objection process:

6.9.1 Currently objections are managed directly by the Valuer General’s office as objections only relate to the valuation of land.

6.9.2 However, the proposed changes to the rating strategy may see an increase in objections relating to the classification of land.

6.9.3 An internal objection process (found via Council’s website) will be available to all ratepayers who wish to object on the classification of their property (e.g., if the property does not satisfy the definition of vacant, derelict or unactivated retail land.

6.9.4 Alternatively, under Section 183 of the Local Government Act 1989 ratepayers are able to apply to VCAT for review of Council’s decision to classify (or not classify) land as a particular type or class for differential rating purposes. Such applications are made directly to VCAT and must be lodged within 60 days after the owner/occupier first receives the rate notice. Once referred to VCAT, the procedure in Part III of the Valuation of Land Act 1960 applies to the review of the differential rating classification (with any necessary modifications). The final determination is made by VCAT.

7. FINANCIAL IMPACT

7.1 Direction 5 of the Plan “Well Governed” highlights the importance of ‘a financially sustainable, high performing and community focused organisation’ to underpin delivery of the direction and outcomes defined in the Plan.

7.2 As outlined under Financial Strategy in this report, this Plan operates within the rates cap and maintains financial sustainability while maintaining or improving service delivery and community assets.

7.3 Any resource implications of proposed adjustments to the updated Council Plan have been represented in the Financial Plan (10-year) and Budget 2024/25.

7.4 The Rating Strategy review does not impact on the total rates revenue that is raised each year, which is determined by the annual budget process and in accordance with the requirements of rate capping legislation.

7.4.1 The proposed change to the Rating Strategy will change the rates burden (rates payable) between different rates payers. Charging higher differential rates for Vacant Land, Derelict Land and Unactivated Retail Land will reduce the rates burden for other ratepayers.

7.4.2 Any successful objections by ratepayers on differential ratings may alter Council’s rates income. However, it is expected this to be minimal or minor financial impact.

8. ENVIRONMENTAL IMPACT

8.1 The strategic direction, Sustainable Port Phillip is a key outcome for our City with a sustainable future, where our community benefits from living in a bayside city that is cleaner, greener, cooler and more beautiful.

8.2 In our long-term challenge, Climate change and the environment, we aim to reduce our own emissions and prepare our City and community for a changing environment. This requires investment in our assets, changing how we deliver our services and working with our community and partners to mitigate and adapt to climate change.

8.3 This focus aims to underpin Council’s resolution of calling a climate emergency. We are building our first Climate Emergency Plan.

8.4 There are several additional investments designed to improve environmental outcomes including:

8.4.1 Additional funding commitment to facilitate the implementation of the Act and Adapt Strategy 2023-2028 continuing to improve the City’s climate resilience.

8.4.2 Ongoing Waste Transformation Program as outlined in the Don’t Waste It! Waste Management Strategy which includes new waste services such as FOGO and Glass recycling.

8.4.3 Elwood Foreshore Redevelopment (which includes greater climate resilience of infrastructure).

8.4.4 Enhanced drainage cleaning to mitigate impacts of flooding.

8.4.5 Fully funded Public Space Strategy.

8.4.6 Investment in high-cost engineering solutions to improve electrical line clearance compliance while reducing the impact on tree canopy coverage.

8.4.7 Continuing our annual Greening Port Phillip Program and developing a new Urban Forest Strategy and Street Tree Planting Program.

8.4.8 Greater focus on climate resilience and environmental sustainability in asset management as outlined in the Enterprise Asset Management Plan 2022-2032.

9. COMMUNITY IMPACT

9.1 The Council Plan 2021-31 updated for year four and Budget 2024/25 provides the foundation, directions and strategies needed to fulfil the various functions required of councils under the LGA and other legislation. It defines what Council will deliver over the next ten years, by identifying what we will provide, how we will work in partnership with other entities and what we will advocate for on behalf of our communities.

9.2 The proposed changes to the Council’s Rating Strategy 2022-25 are likely to have several direct and indirect impacts on the community:

9.2.1 Affordability - The Rating Strategy, together with other Council policy initiatives, must consider the possibility that rates may become unaffordable for groups in the community. In response to this, the Rating Strategy retains an emphasis on targeted support for financially disadvantaged members of our community. This is managed through Council Financial Hardship Policy.

9.2.2 Safety – The higher rating burden associated with derelict, vacant and unactivated retail land is likely to establish a significant disincentive for these land types and ultimately reduce their prevalence in the municipality. In turn this will help mitigate the safety and amenity concerns around these types of land (e.g., unsafe buildings, anti-social behaviour etc).

9.2.3 Vibrant City – The higher rating burden associated with derelict, vacant and unactivated retail land is likely to establish a significant disincentive for these land types and ultimately reduce their prevalence in the municipality. In turn this will help improve the vibrancy of the municipality to ensure that land is used to it’s full potentially (e.g., to increase the availability of housing or to ensure that High Streets are activated).

9.2.4 Economic - The Rating Strategy, together with other Council policy initiatives, aim to mitigate the economic impacts on business and the impact on the wider, economic viability of the community caused by the prevalence of vacant land, derelict land and unactivated retail land.

9.3 There are also a number of specific changes to the Council Plan 2021-2031 updated for year four following community engagement, including the Budget 2024/25 that have specific community impacts:

9.3.1 Funding to improve the Elwood Park Tennis Club providing improved access to sporting facilities within the municipality.

9.3.2 South Melbourne Symphony Orchestra to provide to the South Melbourne Symphony Orchestra $9,000 per annum commencing 2024/25, for three-years, to cover the budget shortfall caused by the need to rent a space outside the municipality while the South Melbourne Town Hall undergoes works.

10. ALIGNMENT TO COUNCIL PLAN AND COUNCIL POLICY

10.1 The proposed updated Council Plan 2021-31 for year four, once adopted, will replace the current version of the plan.

11. IMPLEMENTATION STRATEGY

11.1 TIMELINE

11.1.1 A rates brochure will be distributed in conjunction with the issuing of rate notices in August 2024.

11.1.2 Officers will provide a final copy of the Council Plan to Department of Health following its adoption by Council.

11.2 COMMUNICATION

11.2.1 Each person or organisation that has emailed feedback or requested follow-up information will be notified in writing, thanking them for their feedback, advising them of the Council decision and the reasons for that decision.

11.2.2 The final designed and updated Council Plan 2021-31 Year 4 document, which includes the Budget 2024/25, will be promoted on Council’s website as an interactive document, with hard copies made available at local libraries and service centres.

12. OFFICER DIRECT OR INDIRECT INTEREST

12.1 No officers involved in the preparation of this report have any material or general interest in the matter.

|

ATTACHMENTS |

1. Rating Strategy 2022-2025 (Updated 2024) 2. Council Plan 2021-31 (Year Four) and Budget 2024-25

Volume 1 3. Council Plan 2021-31 (Year Four) and Budget 2024-25

Volume 2 4. Council Plan 2021-31 (Year Four) and Budget 2024-25

Volume 3 5. Financial changes identified and incorporated into

Budget 2024-25 6. Schedule Cultural and Recreational Lands Act 1963 -

Rates Grants 2024-25 7. Office of Housing Elderly Persons - General Rates

Waiver Agreement 2024-25 8. Council Plan 2021-32 Year 4, Budget 2024-25 and

Rating Strategy - Engagement Summary Report 9. Council Plan 2021-32 Year 4, Budget 2024-25 and

Rating Strategy - Engagement Submissions

|

|

Council Plan 2021-32 Year 4, Budget 2024-25 and Rating Strategy - Engagement Summary Report |

|

Council Plan 2021-32 Year 4, Budget 2024-25 and Rating Strategy - Engagement Submissions |